Spruce Point Alerts & Updates

Information, analysis and actionable ideas to help you see the other side of the Wall Street hype machine.

Information, analysis and actionable ideas to help you see the other side of the Wall Street hype machine.

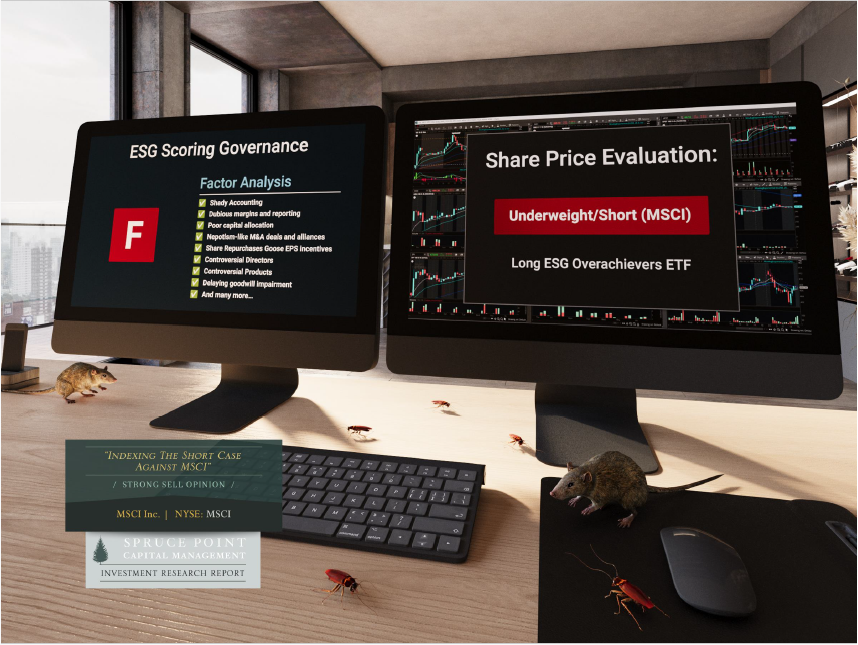

After conducting a forensic financial review of MSCI (founded as Morgan Stanley Capital International), a provider of decision support tools and solutions for the global investment community, Spruce Point believes the business' four main segments are under pressure and facing client retention challenges. Based on our investigation, we estimate a 55% to 65% long-term downside risk, or $190.00 – $244.00 per share.

The report highlights several key concerns with the company, including:

Spruce Point Capital short position on MSCI highlights concentration of index providers

By downloading from, or viewing material on, this website you agree to the following Terms of Service. Use of Spruce Point Capital Management LLC’s research is at your own risk. In no event should Spruce Point Capital Management LLC or any affiliated party be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

You should assume that as of the publication date of any short-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Likewise, you should assume that as of the publication date of any long-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a long position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein rises. Following publication of any long or short report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. . Such an offer or solicitation can only be made by the confidential private placement memoranda relating to the investment vehicles managed by Spruce Point Capital Management, LLC (the “firm”), which the firm will provide only to qualified offerees. Spruce Point Capital Management LLC is registered with the SEC as an investment advisor. However, you should not assume that any discussion or information contained in this presentation serves as the receipt of personalized investment advice from Spruce Point Capital Management LLC. Spruce Point Capital Management LLC is not registered as a broker/dealer or accounting firm.

To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management LLC does not undertake to update or supplement this report or any of the information contained herein.

If you are in the United Kingdom, you confirm that you are subscribing and/or accessing Spruce Point Capital Management LLC research and materials on behalf of:

(A) a high net worth entity (e.g., a company with net assets of GBP 5 million or a high value trust) falling within Article 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or

(B) an investment professional (e.g., a financial institution, government or local authority, or international organization) falling within Article 19 of the FPO.

You agree that the information on this website is copyrighted, and you therefore agree not to distribute this information (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link — http://www.sprucepointcap.com

If you have obtained Spruce Point Capital Management LLC research in any manner other than by download from the aforementioned link, you may not read such research without going to the aforementioned link and agreeing to the Terms of Service. You further agree that any dispute arising from your use of this report and / or the Spruce Point Capital Management LLC website or viewing the material hereon shall be governed by the laws of New York, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the superior courts located within the State of New York and waive your right to any other jurisdiction or applicable law, given that Spruce Point Capital Management LLC has an office in New York. The failure of Spruce Point Capital Management LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Spruce Point Capital Management LLC and the terms, logos and marks included on this Site that identify Spruce Point services and products are proprietary materials. Copyright in the pages and in the screens of this website, and in the information and material therein, is proprietary material owned by Spruce Point Capital Management LLC unless otherwise indicated. Unless otherwise noted, all information provided on this site is provided by Spruce Point Capital Management, LLC and is subject to copyright and trademark laws. Logos and marks contained in links to third party sites belong to their respective owners. All users may not reproduce, modify, copy, alter in any way, distribute, sell, resell, transmit, transfer, license, assign or publish such information.

By downloading from, or viewing material on, this website you agree to the following Terms of Service. Use of Spruce Point Capital Management LLC’s research is at your own risk. In no event should Spruce Point Capital Management LLC or any affiliated party be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

You should assume that as of the publication date of any short-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Likewise, you should assume that as of the publication date of any long-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a long position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein rises. Following publication of any long or short report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. . Such an offer or solicitation can only be made by the confidential private placement memoranda relating to the investment vehicles managed by Spruce Point Capital Management, LLC (the “firm”), which the firm will provide only to qualified offerees. Spruce Point Capital Management LLC is registered with the SEC as an investment advisor. However, you should not assume that any discussion or information contained in this presentation serves as the receipt of personalized investment advice from Spruce Point Capital Management LLC. Spruce Point Capital Management LLC is not registered as a broker/dealer or accounting firm.

To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management LLC does not undertake to update or supplement this report or any of the information contained herein.

If you are in the United Kingdom, you confirm that you are subscribing and/or accessing Spruce Point Capital Management LLC research and materials on behalf of:

(A) a high net worth entity (e.g., a company with net assets of GBP 5 million or a high value trust) falling within Article 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or

(B) an investment professional (e.g., a financial institution, government or local authority, or international organization) falling within Article 19 of the FPO.

You agree that the information on this website is copyrighted, and you therefore agree not to distribute this information (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link — http://www.sprucepointcap.com

If you have obtained Spruce Point Capital Management LLC research in any manner other than by download from the aforementioned link, you may not read such research without going to the aforementioned link and agreeing to the Terms of Service. You further agree that any dispute arising from your use of this report and / or the Spruce Point Capital Management LLC website or viewing the material hereon shall be governed by the laws of New York, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the superior courts located within the State of New York and waive your right to any other jurisdiction or applicable law, given that Spruce Point Capital Management LLC has an office in New York. The failure of Spruce Point Capital Management LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Spruce Point Capital Management LLC and the terms, logos and marks included on this Site that identify Spruce Point services and products are proprietary materials. Copyright in the pages and in the screens of this website, and in the information and material therein, is proprietary material owned by Spruce Point Capital Management LLC unless otherwise indicated. Unless otherwise noted, all information provided on this site is provided by Spruce Point Capital Management, LLC and is subject to copyright and trademark laws. Logos and marks contained in links to third party sites belong to their respective owners. All users may not reproduce, modify, copy, alter in any way, distribute, sell, resell, transmit, transfer, license, assign or publish such information.

By downloading from, or viewing material on, this website you agree to the following Terms of Service. Use of Spruce Point Capital Management LLC’s research is at your own risk. In no event should Spruce Point Capital Management LLC or any affiliated party be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

You should assume that as of the publication date of any short-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Likewise, you should assume that as of the publication date of any long-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a long position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein rises. Following publication of any long or short report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. . Such an offer or solicitation can only be made by the confidential private placement memoranda relating to the investment vehicles managed by Spruce Point Capital Management, LLC (the “firm”), which the firm will provide only to qualified offerees. Spruce Point Capital Management LLC is registered with the SEC as an investment advisor. However, you should not assume that any discussion or information contained in this presentation serves as the receipt of personalized investment advice from Spruce Point Capital Management LLC. Spruce Point Capital Management LLC is not registered as a broker/dealer or accounting firm.

To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management LLC does not undertake to update or supplement this report or any of the information contained herein.

If you are in the United Kingdom, you confirm that you are subscribing and/or accessing Spruce Point Capital Management LLC research and materials on behalf of:

(A) a high net worth entity (e.g., a company with net assets of GBP 5 million or a high value trust) falling within Article 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or

(B) an investment professional (e.g., a financial institution, government or local authority, or international organization) falling within Article 19 of the FPO.

You agree that the information on this website is copyrighted, and you therefore agree not to distribute this information (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link — http://www.sprucepointcap.com

If you have obtained Spruce Point Capital Management LLC research in any manner other than by download from the aforementioned link, you may not read such research without going to the aforementioned link and agreeing to the Terms of Service. You further agree that any dispute arising from your use of this report and / or the Spruce Point Capital Management LLC website or viewing the material hereon shall be governed by the laws of New York, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the superior courts located within the State of New York and waive your right to any other jurisdiction or applicable law, given that Spruce Point Capital Management LLC has an office in New York. The failure of Spruce Point Capital Management LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Spruce Point Capital Management LLC and the terms, logos and marks included on this Site that identify Spruce Point services and products are proprietary materials. Copyright in the pages and in the screens of this website, and in the information and material therein, is proprietary material owned by Spruce Point Capital Management LLC unless otherwise indicated. Unless otherwise noted, all information provided on this site is provided by Spruce Point Capital Management, LLC and is subject to copyright and trademark laws. Logos and marks contained in links to third party sites belong to their respective owners. All users may not reproduce, modify, copy, alter in any way, distribute, sell, resell, transmit, transfer, license, assign or publish such information.

By downloading from, or viewing material on, this website you agree to the following Terms of Service. Use of Spruce Point Capital Management LLC’s research is at your own risk. In no event should Spruce Point Capital Management LLC or any affiliated party be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

You should assume that as of the publication date of any short-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Likewise, you should assume that as of the publication date of any long-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a long position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein rises. Following publication of any long or short report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. . Such an offer or solicitation can only be made by the confidential private placement memoranda relating to the investment vehicles managed by Spruce Point Capital Management, LLC (the “firm”), which the firm will provide only to qualified offerees. Spruce Point Capital Management LLC is registered with the SEC as an investment advisor. However, you should not assume that any discussion or information contained in this presentation serves as the receipt of personalized investment advice from Spruce Point Capital Management LLC. Spruce Point Capital Management LLC is not registered as a broker/dealer or accounting firm.

To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management LLC does not undertake to update or supplement this report or any of the information contained herein.

If you are in the United Kingdom, you confirm that you are subscribing and/or accessing Spruce Point Capital Management LLC research and materials on behalf of:

(A) a high net worth entity (e.g., a company with net assets of GBP 5 million or a high value trust) falling within Article 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or

(B) an investment professional (e.g., a financial institution, government or local authority, or international organization) falling within Article 19 of the FPO.

You agree that the information on this website is copyrighted, and you therefore agree not to distribute this information (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link — http://www.sprucepointcap.com

If you have obtained Spruce Point Capital Management LLC research in any manner other than by download from the aforementioned link, you may not read such research without going to the aforementioned link and agreeing to the Terms of Service. You further agree that any dispute arising from your use of this report and / or the Spruce Point Capital Management LLC website or viewing the material hereon shall be governed by the laws of New York, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the superior courts located within the State of New York and waive your right to any other jurisdiction or applicable law, given that Spruce Point Capital Management LLC has an office in New York. The failure of Spruce Point Capital Management LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Spruce Point Capital Management LLC and the terms, logos and marks included on this Site that identify Spruce Point services and products are proprietary materials. Copyright in the pages and in the screens of this website, and in the information and material therein, is proprietary material owned by Spruce Point Capital Management LLC unless otherwise indicated. Unless otherwise noted, all information provided on this site is provided by Spruce Point Capital Management, LLC and is subject to copyright and trademark laws. Logos and marks contained in links to third party sites belong to their respective owners. All users may not reproduce, modify, copy, alter in any way, distribute, sell, resell, transmit, transfer, license, assign or publish such information.

By downloading from, or viewing material on, this website you agree to the following Terms of Service. Use of Spruce Point Capital Management LLC’s research is at your own risk. In no event should Spruce Point Capital Management LLC or any affiliated party be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

You should assume that as of the publication date of any short-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Likewise, you should assume that as of the publication date of any long-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a long position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein rises. Following publication of any long or short report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. . Such an offer or solicitation can only be made by the confidential private placement memoranda relating to the investment vehicles managed by Spruce Point Capital Management, LLC (the “firm”), which the firm will provide only to qualified offerees. Spruce Point Capital Management LLC is registered with the SEC as an investment advisor. However, you should not assume that any discussion or information contained in this presentation serves as the receipt of personalized investment advice from Spruce Point Capital Management LLC. Spruce Point Capital Management LLC is not registered as a broker/dealer or accounting firm.

To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management LLC does not undertake to update or supplement this report or any of the information contained herein.

If you are in the United Kingdom, you confirm that you are subscribing and/or accessing Spruce Point Capital Management LLC research and materials on behalf of:

(A) a high net worth entity (e.g., a company with net assets of GBP 5 million or a high value trust) falling within Article 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or

(B) an investment professional (e.g., a financial institution, government or local authority, or international organization) falling within Article 19 of the FPO.

You agree that the information on this website is copyrighted, and you therefore agree not to distribute this information (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link — http://www.sprucepointcap.com

If you have obtained Spruce Point Capital Management LLC research in any manner other than by download from the aforementioned link, you may not read such research without going to the aforementioned link and agreeing to the Terms of Service. You further agree that any dispute arising from your use of this report and / or the Spruce Point Capital Management LLC website or viewing the material hereon shall be governed by the laws of New York, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the superior courts located within the State of New York and waive your right to any other jurisdiction or applicable law, given that Spruce Point Capital Management LLC has an office in New York. The failure of Spruce Point Capital Management LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Spruce Point Capital Management LLC and the terms, logos and marks included on this Site that identify Spruce Point services and products are proprietary materials. Copyright in the pages and in the screens of this website, and in the information and material therein, is proprietary material owned by Spruce Point Capital Management LLC unless otherwise indicated. Unless otherwise noted, all information provided on this site is provided by Spruce Point Capital Management, LLC and is subject to copyright and trademark laws. Logos and marks contained in links to third party sites belong to their respective owners. All users may not reproduce, modify, copy, alter in any way, distribute, sell, resell, transmit, transfer, license, assign or publish such information.

By downloading from, or viewing material on, this website you agree to the following Terms of Service. Use of Spruce Point Capital Management LLC’s research is at your own risk. In no event should Spruce Point Capital Management LLC or any affiliated party be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

You should assume that as of the publication date of any short-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Likewise, you should assume that as of the publication date of any long-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a long position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein rises. Following publication of any long or short report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. . Such an offer or solicitation can only be made by the confidential private placement memoranda relating to the investment vehicles managed by Spruce Point Capital Management, LLC (the “firm”), which the firm will provide only to qualified offerees. Spruce Point Capital Management LLC is registered with the SEC as an investment advisor. However, you should not assume that any discussion or information contained in this presentation serves as the receipt of personalized investment advice from Spruce Point Capital Management LLC. Spruce Point Capital Management LLC is not registered as a broker/dealer or accounting firm.

To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management LLC does not undertake to update or supplement this report or any of the information contained herein.

If you are in the United Kingdom, you confirm that you are subscribing and/or accessing Spruce Point Capital Management LLC research and materials on behalf of:

(A) a high net worth entity (e.g., a company with net assets of GBP 5 million or a high value trust) falling within Article 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or

(B) an investment professional (e.g., a financial institution, government or local authority, or international organization) falling within Article 19 of the FPO.

You agree that the information on this website is copyrighted, and you therefore agree not to distribute this information (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link — http://www.sprucepointcap.com

If you have obtained Spruce Point Capital Management LLC research in any manner other than by download from the aforementioned link, you may not read such research without going to the aforementioned link and agreeing to the Terms of Service. You further agree that any dispute arising from your use of this report and / or the Spruce Point Capital Management LLC website or viewing the material hereon shall be governed by the laws of New York, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the superior courts located within the State of New York and waive your right to any other jurisdiction or applicable law, given that Spruce Point Capital Management LLC has an office in New York. The failure of Spruce Point Capital Management LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Spruce Point Capital Management LLC and the terms, logos and marks included on this Site that identify Spruce Point services and products are proprietary materials. Copyright in the pages and in the screens of this website, and in the information and material therein, is proprietary material owned by Spruce Point Capital Management LLC unless otherwise indicated. Unless otherwise noted, all information provided on this site is provided by Spruce Point Capital Management, LLC and is subject to copyright and trademark laws. Logos and marks contained in links to third party sites belong to their respective owners. All users may not reproduce, modify, copy, alter in any way, distribute, sell, resell, transmit, transfer, license, assign or publish such information.

By downloading from, or viewing material on, this website you agree to the following Terms of Service. Use of Spruce Point Capital Management LLC’s research is at your own risk. In no event should Spruce Point Capital Management LLC or any affiliated party be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

You should assume that as of the publication date of any short-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Likewise, you should assume that as of the publication date of any long-biased report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a long position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein rises. Following publication of any long or short report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. . Such an offer or solicitation can only be made by the confidential private placement memoranda relating to the investment vehicles managed by Spruce Point Capital Management, LLC (the “firm”), which the firm will provide only to qualified offerees. Spruce Point Capital Management LLC is registered with the SEC as an investment advisor. However, you should not assume that any discussion or information contained in this presentation serves as the receipt of personalized investment advice from Spruce Point Capital Management LLC. Spruce Point Capital Management LLC is not registered as a broker/dealer or accounting firm.

To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management LLC does not undertake to update or supplement this report or any of the information contained herein.

If you are in the United Kingdom, you confirm that you are subscribing and/or accessing Spruce Point Capital Management LLC research and materials on behalf of:

(A) a high net worth entity (e.g., a company with net assets of GBP 5 million or a high value trust) falling within Article 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or

(B) an investment professional (e.g., a financial institution, government or local authority, or international organization) falling within Article 19 of the FPO.

You agree that the information on this website is copyrighted, and you therefore agree not to distribute this information (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link — http://www.sprucepointcap.com

If you have obtained Spruce Point Capital Management LLC research in any manner other than by download from the aforementioned link, you may not read such research without going to the aforementioned link and agreeing to the Terms of Service. You further agree that any dispute arising from your use of this report and / or the Spruce Point Capital Management LLC website or viewing the material hereon shall be governed by the laws of New York, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the superior courts located within the State of New York and waive your right to any other jurisdiction or applicable law, given that Spruce Point Capital Management LLC has an office in New York. The failure of Spruce Point Capital Management LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Spruce Point Capital Management LLC and the terms, logos and marks included on this Site that identify Spruce Point services and products are proprietary materials. Copyright in the pages and in the screens of this website, and in the information and material therein, is proprietary material owned by Spruce Point Capital Management LLC unless otherwise indicated. Unless otherwise noted, all information provided on this site is provided by Spruce Point Capital Management, LLC and is subject to copyright and trademark laws. Logos and marks contained in links to third party sites belong to their respective owners. All users may not reproduce, modify, copy, alter in any way, distribute, sell, resell, transmit, transfer, license, assign or publish such information.

See the other side of the Wall Street hype machine.